Goldman Leads SuperMicro Stock Offering Just Two Weeks After Initiating Superbullish Coverage on The Stock

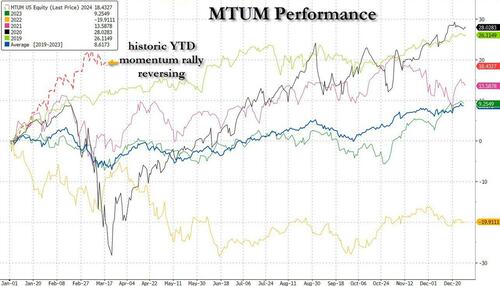

And like that, the record momentum rally of 2024 is over.

Just over a month ago, when the batshit insane momentum chasing mania of January and February had sent a bunch of "AI names" such as Nvidia, Arm Holdings and SuperMicro to idiotic levels, we asked when would management teams admit that the move was galactically stupid and "surprise' markets with an equity offering.

When does SMCI announce an equity offering

— zerohedge (@zerohedge) February 15, 2024

The answer: one month later.

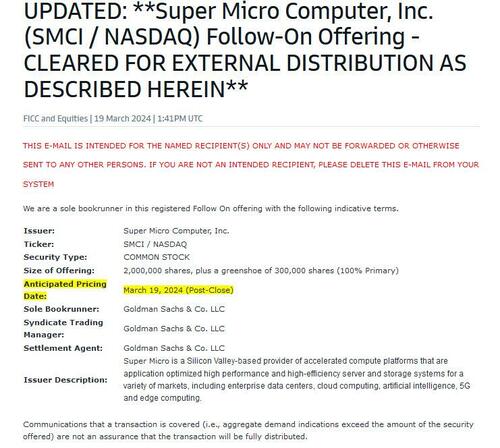

This morning, Super Micro Computer was the first of the massively overvalued AI assorted hangers on to offer to sell 2 million shares of common stock in a public offering that could raise as much as $2 billion.

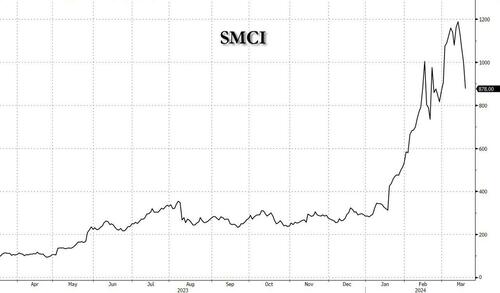

The computer server maker has been on a stock market tear of late, riding the wave of enthusiasm in artificial intelligence to a gain of nearly 1,000% over the past 12 months, and earning a $56 billion market cap. Its stock, whose recent rally dwarfs even that of Nvidia Corp., was just added to the S&P 500 Index, a confirmation of its ascension into the big leagues and exposing it to an ever-larger base of investors.

According to Bloomberg, the company is offering shares at $900 to $1000.68 each, people familiar with the matter told Bloomberg, although judging by the plunge in the stock price, SMCI hasn't sold a whole lot in that range: the stock was last trading down 13% around $870, well below the bottom end of the rane.

And while the offering was very predictable, there was an extra dose of humor on the side.

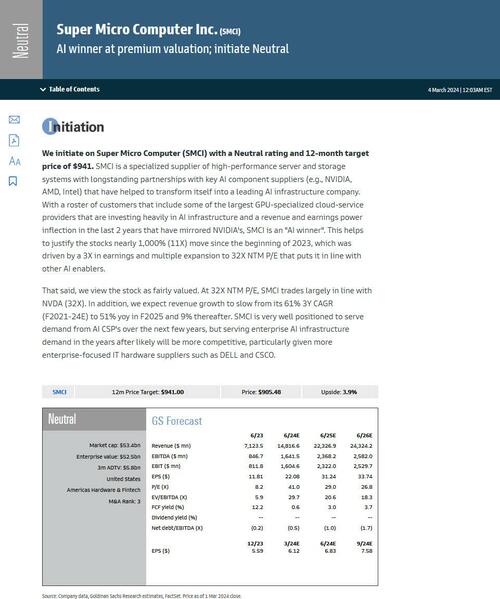

Recall, that just two weeks ago, during the momentum bubble's blow-off top phase, Goldman hilariously came out and after having ignored the stocks - well - forever, the vampire squid issued an initiative coverage report with a $941 price target and a Neutral rating...

Goldman starts coverage of Super Micro Computer with a neutral rating and $941 price target; bank views shares of the server maker as fairly valued after 1,000% surge since the beginning of 2023.

— zerohedge (@zerohedge) March 4, 2024

PT is now below SMCI's price after latest weekend meltup

... a report in which we read that "SMCI is an "AI winner". This helps to justify the stocks nearly 1,000% (11X) move since the beginning of 2023, which was driven by a 3X in earnings and multiple expansion to 32X NTM P/E that puts it in line with other AI enablers."

So imagine our shock when today we learned that not only is SMCI selling 2 million shares but that, drumroll, Goldman Sachs was the sole underwriter for the proposed offering.

And now that the stock is puking on the dilution from the Goldman-led offering (where we expect Goldman will pocket no less than 3% of the proceeds) which will serve as a ceiling for the stock for the foreseeable future since any time it rises above $900 there will be an immediate flood of shares for sale, Goldman is also benefiting from the millions it is making this morning by covering the stock it shorted to retail and institutional investors it got to buy on its reco two weeks ago.

And that is how you make a killing on Wall Street in just two weeks.